Introduction

A leaking pipe hidden behind a wall can lead to major headaches for homeowners. Beyond the visible water damage, moisture can quietly weaken your structure, destroy drywall, and create mold. Many people assume their homeowners insurance will automatically cover the repairs— but that isn’t always true.

At Springdale Plumbing Services, we’ve helped countless Northwest Arkansas homeowners identify hidden leaks, document the issue for insurance purposes, and complete the repairs quickly. Understanding how insurance coverage works can save you both time and frustration when water damage strikes.

1. What Homeowners Insurance Typically Covers

Most homeowners insurance policies cover “sudden and accidental” water damage. That means if a pipe bursts unexpectedly and floods your home, your insurance will often pay for the resulting damage—but not necessarily for the plumbing repair itself.

Coverage may include:

- Water extraction and drying

- Damaged drywall or flooring replacement

- Mold remediation (depending on your policy)

- Opening and closing walls to access the leak

However, replacing the actual broken pipe or fitting usually isn’t covered. Insurance focuses on repairing the damage caused by the leak, not the plumbing component that caused it.

2. What Insurance Usually Does NOT Cover

Insurance providers distinguish between sudden events and problems caused by wear, corrosion, or neglect. When damage develops gradually over time, it’s viewed as a maintenance issue rather than an accident.

Here are common exclusions:

- Leaks from rusted or corroded pipes

- Water damage caused by poor insulation during freezing weather

- Long-term drips behind walls or under floors

- Seepage from unsealed joints or caulking failures

- Leaks caused by lack of routine maintenance

If your insurer determines that a leak was ongoing or due to neglect, your claim could be denied.

3. Determining Whether a Leak Is “Sudden and Accidental”

The difference between “sudden” and “gradual” damage determines whether your claim is approved.

Covered situations often include:

- A pipe that bursts suddenly due to high pressure

- A fitting that unexpectedly breaks or comes loose

- A new pipe that fails soon after installation

If your plumber discovers long-term rust, mold, or previous repairs, insurers are likely to consider it a gradual issue, which typically isn’t covered.

4. How Plumbers Help with Insurance Claims

Professional documentation makes all the difference when filing a claim. Licensed plumbers play an essential role in helping you prove your damage was sudden and accidental.

At Springdale Plumbing Services, we:

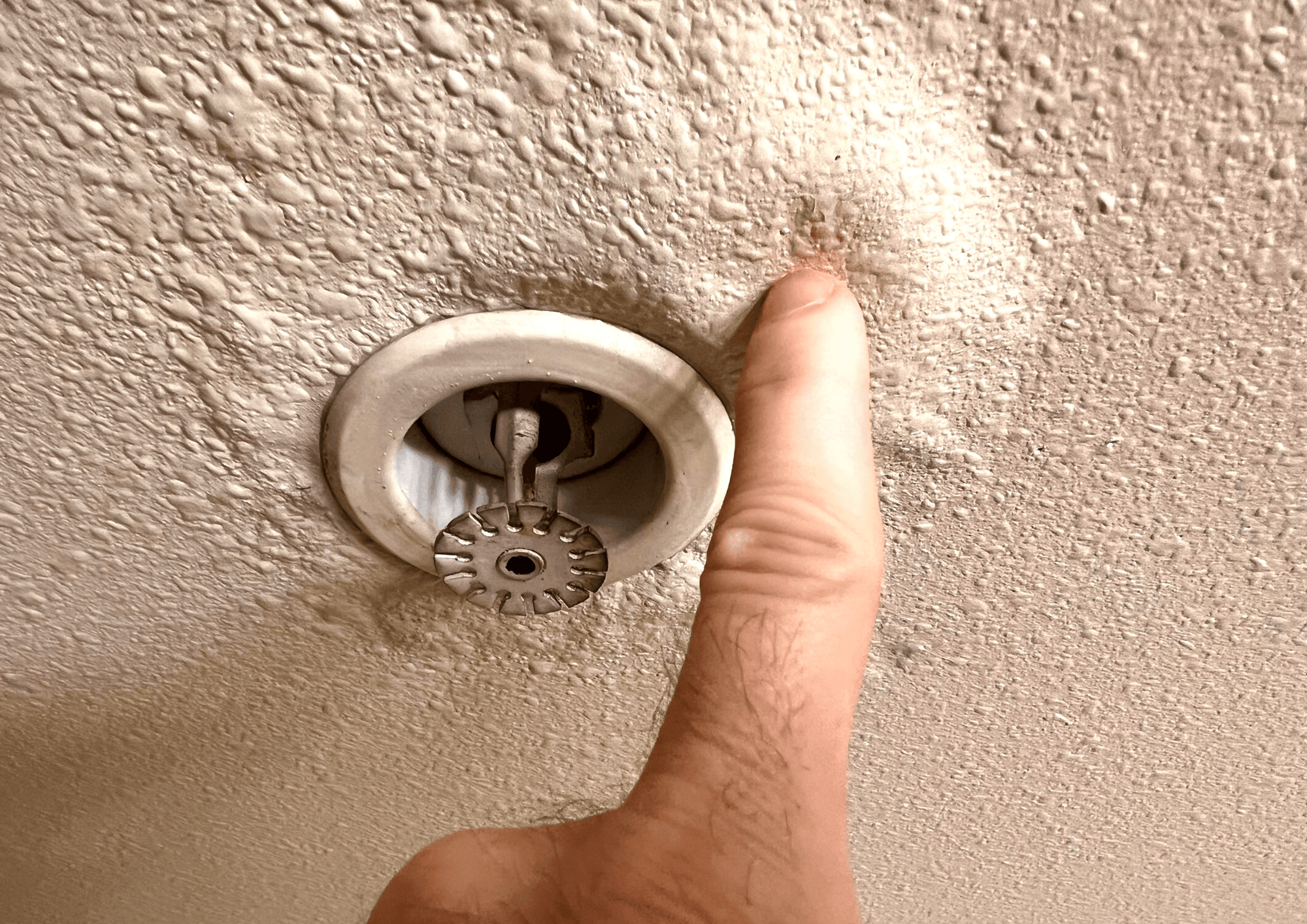

- Identify the exact source of the leak using non-invasive tools

- Take clear photos and detailed notes for your insurance adjuster

- Provide written documentation to confirm the cause and timing of the leak

- Coordinate with restoration crews for water cleanup and repairs

Having professional inspection reports often strengthens your claim and speeds up the approval process.

5. Covered vs. Uncovered Scenarios

| Situation | Covered | Explanation |

|---|---|---|

| Pipe bursts due to sudden pressure | ✅ Yes | Sudden and accidental damage |

| Pipe leaks slowly over time | ❌ No | Gradual damage considered neglect |

| Frozen pipe bursts during cold weather | ✅ Yes (if properly insulated) | Unexpected failure, not neglect |

| Water damage from failed tub caulk | ❌ No | Maintenance issue |

| Supply line bursts unexpectedly | ✅ Yes | Sudden, accidental breakage |

Understanding these examples helps homeowners respond quickly and document properly to maximize potential coverage.

6. Steps to Take If You Discover a Leak

If you suspect a leaking pipe behind your wall, act immediately:

- Shut off your main water supply to prevent further damage.

- Call a licensed plumber for professional leak detection.

- Document everything, take photos or video before cleanup begins.

- Contact your insurance company to start your claim.

- Avoid DIY repairs, which can complicate the inspection and documentation process.

Quick action reduces damage and strengthens your insurance claim.

7. How Springdale Plumbing Services Helps

Our experienced team uses advanced leak detection tools to locate problems quickly and accurately without unnecessary damage to your walls.

We also provide:

- Detailed inspection reports for insurance documentation

- Transparent pricing and clear repair options

- Direct communication with your insurance adjuster when needed

We know that dealing with hidden leaks can be stressful, so our focus is on fast, accurate repairs and helping you through the insurance process with confidence and clarity.

8. Preventing Future Leaks

Preventive maintenance is always more affordable than emergency repairs. Here’s how to protect your home:

- Schedule annual plumbing inspections with a licensed plumber.

- Check for small drips, soft drywall, or unusual water pressure changes.

- Replace old or corroded pipes before they fail.

- Insulate exposed plumbing in cold areas.

- Install a smart water leak detection system for early alerts.

Staying proactive helps you avoid costly water damage and claim denials.

Conclusion

Homeowners insurance can cover water damage caused by a leaking pipe—but only when the leak is sudden and accidental. Gradual leaks, corrosion, and poor maintenance are generally excluded.

At Springdale Plumbing Services, we specialize in identifying hidden leaks, performing expert repairs, and providing the documentation insurers need for your claim. If you notice damp walls, bubbling paint, or unexplained water bills, call our team today. We’ll find the problem fast and restore your plumbing system with precision and care.